8 Easy Facts About Clark Wealth Partners Explained

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Table of ContentsFacts About Clark Wealth Partners RevealedExcitement About Clark Wealth PartnersSome Known Details About Clark Wealth Partners An Unbiased View of Clark Wealth PartnersThe Facts About Clark Wealth Partners UncoveredThe Ultimate Guide To Clark Wealth PartnersUnknown Facts About Clark Wealth Partners

The globe of financing is a challenging one., for instance, just recently located that virtually two-thirds of Americans were incapable to pass a standard, five-question monetary literacy examination that quizzed individuals on topics such as passion, debt, and other reasonably fundamental principles.In enhancement to managing their existing customers, financial experts will certainly usually invest a fair amount of time every week meeting with potential customers and marketing their services to maintain and expand their company. For those taking into consideration coming to be a monetary advisor, it is essential to consider the average income and job stability for those functioning in the field.

Courses in taxes, estate planning, financial investments, and risk administration can be handy for pupils on this course. Depending upon your special occupation objectives, you may likewise require to gain particular licenses to meet particular clients' needs, such as acquiring and offering stocks, bonds, and insurance plan. It can also be valuable to earn a certification such as a Licensed Economic Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Specialist (PFS).

Unknown Facts About Clark Wealth Partners

What that looks like can be a number of points, and can vary depending on your age and phase of life. Some people fret that they require a particular quantity of money to spend before they can get help from a specialist (financial advisors Ofallon illinois).

Examine This Report about Clark Wealth Partners

If you haven't had any kind of experience with a monetary advisor, right here's what to anticipate: They'll start by offering a comprehensive analysis of where you stand with your properties, liabilities and whether you're fulfilling benchmarks contrasted to your peers for cost savings and retirement. They'll examine brief- and long-term objectives. What's helpful concerning this action is that it is personalized for you.

You're young and functioning full-time, have an auto or 2 and there are trainee loans to settle. Below are some feasible ideas to help: Develop excellent savings routines, repay financial debt, established baseline goals. Settle trainee car loans. Relying on your occupation, you may qualify to have component of your college finance forgoed.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

After that you can review the next finest time for follow-up. Prior to you begin, ask concerning prices. Financial advisors normally have various tiers of rates. Some have minimal asset degrees and will certainly charge a cost typically a number of thousand bucks for creating and changing a strategy, or they might bill a level fee.

Always read the small print, and see to it your monetary expert complies with fiduciary standards. You're expecting your retired life and assisting your children with college expenses. A financial advisor can offer suggestions for those situations and more. Many retired life strategies provide a set-it, forget-it option that designates assets based upon your life stage.

The Definitive Guide for Clark Wealth Partners

That could not be the ideal way to keep building wealth, especially as you advance in your job. Set up normal check-ins with your organizer to tweak your strategy as required. Balancing financial savings for retirement and university expenses for your children can be tricky. A financial expert can aid you focus on.

Believing around you can try this out when you can retire and what post-retirement years might appear like can produce problems regarding whether your retired life savings remain in line with your post-work strategies, or if you have conserved enough to leave a legacy. Assist your monetary professional recognize your strategy to cash. If you are much more traditional with conserving (and possible loss), their recommendations should reply to your worries and issues.

Clark Wealth Partners Things To Know Before You Buy

For instance, preparing for wellness care is one of the huge unknowns in retired life, and a monetary professional can outline alternatives and recommend whether extra insurance policy as protection may be handy. Before you start, try to get comfortable with the concept of sharing your whole economic photo with a professional.

Offering your professional a complete picture can aid them create a plan that's prioritized to all components of your monetary condition, particularly as you're fast approaching your post-work years. If your finances are straightforward and you have a love for doing it yourself, you may be great by yourself.

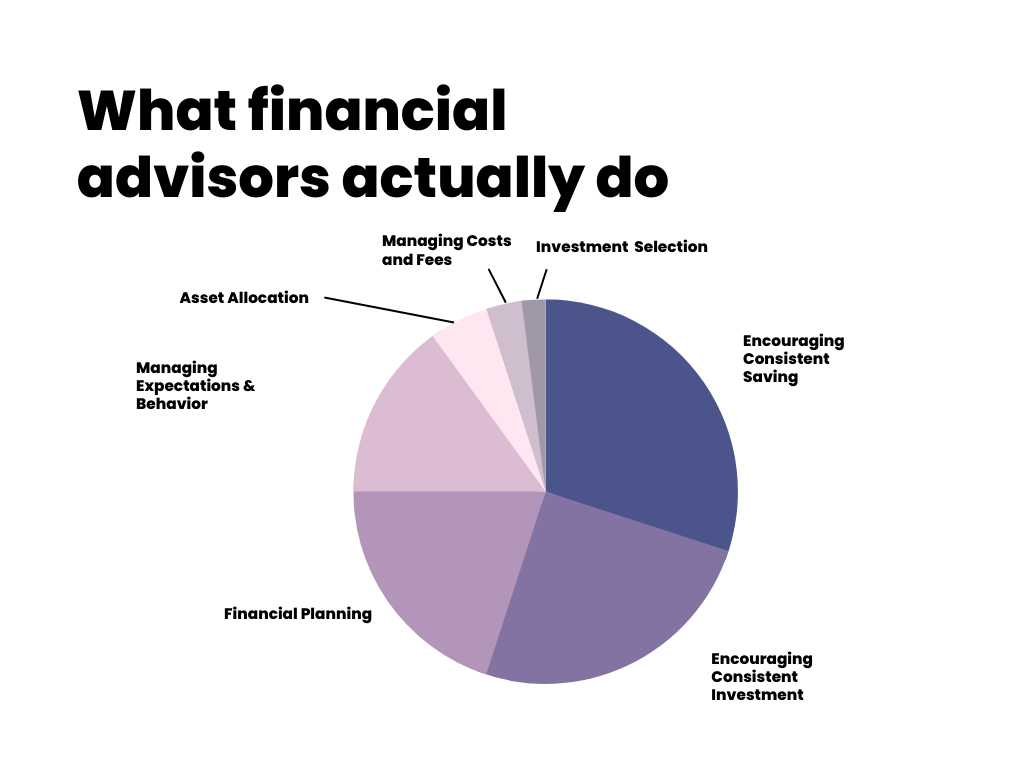

An economic consultant is not only for the super-rich; any person encountering significant life shifts, nearing retirement, or feeling overwhelmed by financial decisions can benefit from specialist advice. This short article checks out the function of economic experts, when you might require to seek advice from one, and crucial considerations for choosing - https://filesharingtalk.com/members/626317-clrkwlthprtnr. An economic consultant is a trained specialist who helps clients manage their finances and make notified decisions that straighten with their life objectives

The Ultimate Guide To Clark Wealth Partners

Compensation versions additionally differ. Fee-only consultants charge a flat charge, hourly rate, or a percentage of possessions under management, which often tends to lower potential disputes of interest. On the other hand, commission-based consultants earn income via the economic products they market, which might affect their recommendations. Whether it is marital relationship, divorce, the birth of a youngster, profession changes, or the loss of a liked one, these occasions have special monetary implications, usually needing timely decisions that can have long-term results.